Income Tax in Japan – Tax Guide For Foreigners in Japan

Calculating Your Tax Bill in Japan – A Guide for Expats

Calculating how much you owe in taxes is challenging enough when you’re living at home. When you’re living abroad in Japan, it can feel pretty well impossible. The good news is that Japan uses a similar tax process as most Western countries. We’ve put together a straightforward guide that should help you figure out approximately how much you’ll owe in Japanese taxes as a resident of japan.

Japan’s progressive tax system

Japan uses a progressive income tax system. This means that the more money you make, the more you’ll owe in taxes. It’s not an equal increase though. It’s not like for every 100 yen you earn, 10 yen will always go the government. Someone earning 2,000,000 yen a year will pay less in taxes per 100 yen than someone earning 20,000,000 yen.

Another important part of the Japanese tax system is that you get to earn 380,000 yen tax-free as a deduction for basic living expenses. If you’re married and have dependents, you could get an extra 380,000 yen deduction per dependent.

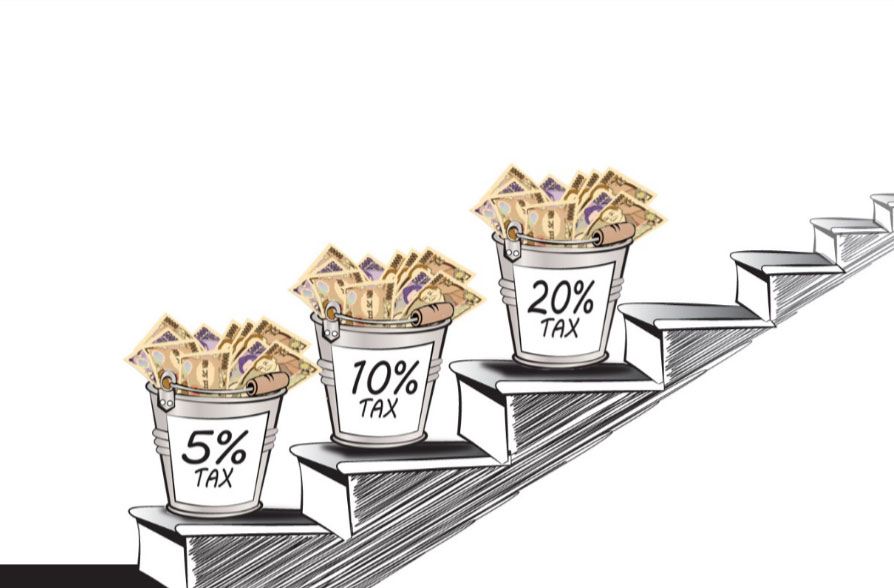

A good way to imagine this system is like a series of buckets. First, your money goes towards the 0% tax-free bucket created from your deductions. After you’ve earned 380,000 in a year, that tax-free bucket is full and then your money will start going into the next bucket, the 5% tax bracket. Up to 1,950,000 can go into this bucket and then it’ll be full as well.

If you earn more income past 1,950,000, that income will start filling up the 10% income bucket. This process will keep going until you’ve made more than 18,000,000 yen and are in the highest tax bracket of 40%. Any money you earn from that point on will go into this bucket.

For your reference, here are the Japanese tax brackets:

|

Taxable Income |

Tax Rate |

|

Less than 1,950,000 yen |

5% |

|

1,950,000 to 3,300,000 yen |

10% |

|

3,300,000 to 6,950,000 yen |

20% |

|

6,950,000 to 9,000,000 yen |

23% |

|

9,000,000 to 18,000,000 yen |

33% |

|

More than 18,000,000 yen |

40% |

Example 1 – Single taxpayer

Let’s say you’re a single taxpayer living in Japan and making 3,380,000 yen a year. Your taxable income after the basic deduction is 3,000,000 yen (3,380,000 – 380,000).

The next 1,950,000 yen of income will go into the 5% bucket and will cost 97,500 yen in taxes (1,950,000 x 5% = 97,500). This leaves 1,050,000 yen in taxable income (3,000,000 – 1,950,000 = 1,050,000). This money will go into the 10% bucket and cost you another 105,000 yen in taxes.

Altogether, your taxes for the year will be 97,500 + 105,000 = 202,500 yen.

Example 2 – Taxpayer with Dependents

The calculation is a little more complicated if you’re married and have dependents but not by much. Let’s say you’re married with one dependent and your income for the year is 7,140,000 yen.

You have 3 basic deductions of 380,000: one for yourself, one for your spouse, and one for your other dependent. Your total basic deduction is 1,140,000 yen (380,000 x 3 = 1,140,000). This means your remaining taxable income is 6,000,000 yen (7,140,000 – 1,140,000).

Going back to our bucket calculation, 1,950,000 will go into the 5% bucket and will cost 97,500 yen in taxes. This leaves you with 4,050,000 of taxable income.

3,300,000 yen of that income will fill up the 10% bucket and cost you 330,000 yen in taxes. The remaining 750,000 yen will go into the 20% bucket and cost you 150,000 yen in taxes.

Altogether, your tax bill for the year will be 97,500 + 330,000 + 150,000 = 577,500 yen.

Don’t let Japan’s foreign tax code get you down.

The calculation is pretty straightforward and very similar to living at home. By using this guide, you should get a very good idea of how much you’ll owe in taxes.

Of course, this doesn’t substitute for professional advice. This also does not include Inhabitant taxes which is a different set of rules altogether. If you’re still concerned about how much you’ll owe or have some special circumstances (like you’re earning income back home) it would be a good idea to talk to a Japanese tax professional. Hopefully, you can sort out your taxes without too much trouble so you can get back to enjoying the rest of your time in Japan. Income Tax in Japan – Tax Guide For Foreigners in Japan. You can also check out the National Tax Agency website for more detailed calculation on employment income deductions at National Tax Agency

For more information on filing taxes in Japan, check out JAPAN INCOME TAX FILING

Or CONTACT US FOR A QUOTE TO FILE YOUR TAXES